If you’ve ever reused a password, signed up for a sketchy site, or stored sensitive info in your browser, there’s a chance your data is floating around the dark web. In 2025 alone, over 16 billion credentials were leaked in various breaches—and yes, that includes emails, passwords, phone numbers, and even scanned IDs.

As a full-time developer, I’ve seen firsthand how easy it is for compromised data to be weaponized. So here’s a practical guide to checking if your personal info is exposed—and what to do if it is.

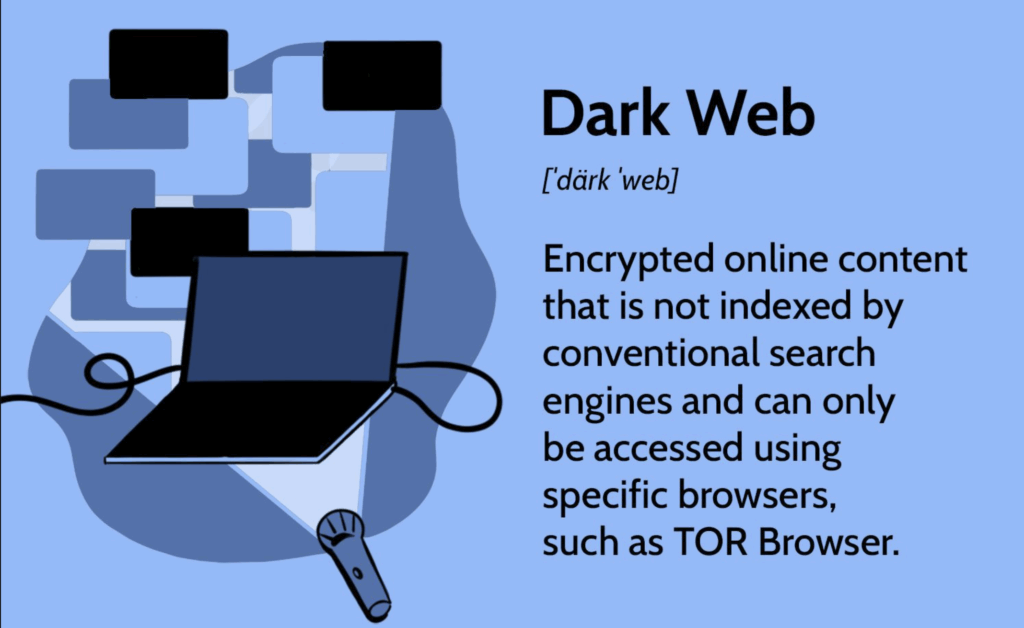

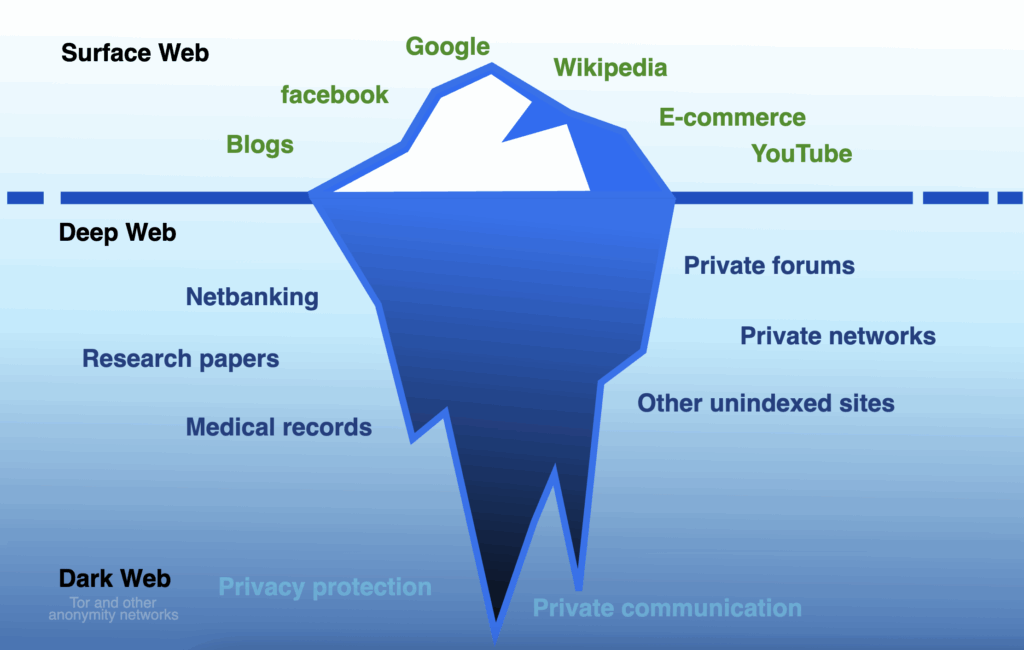

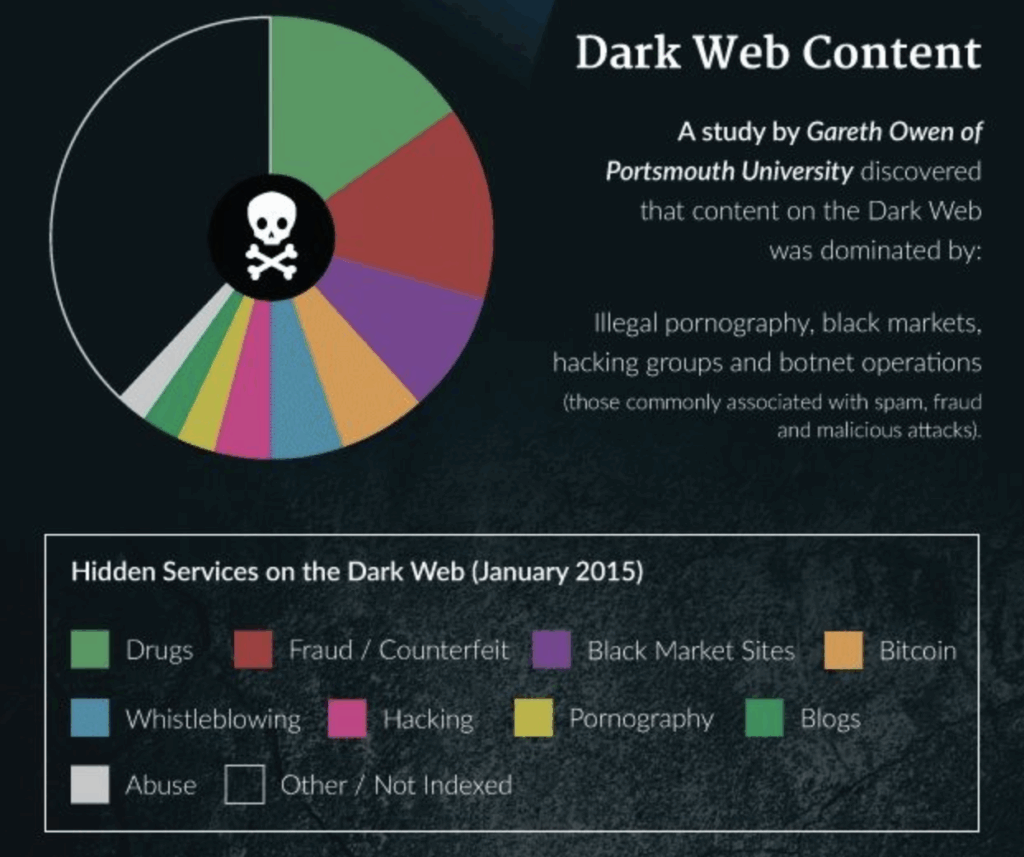

What Is the Dark Web?

The dark web is a hidden part of the internet that requires special tools like the Tor browser to access. It’s where stolen data from breaches gets traded, sold, or dumped. You won’t find it on Google, and you definitely shouldn’t go browsing it yourself.

Commonly Leaked Data:

- Email addresses and passwords

- Phone numbers and home addresses

- Credit card and bank account details

- Scanned documents (passports, licenses)

- Social Security numbers (especially in U.S. breaches)

Step 1: Check If Your Data Is Leaked

You don’t need to be a hacker to find out if your info is out there. These tools do the heavy lifting:

Recommended Dark Web Scanners (2025)

| Tool | Type | What It Checks | Cost |

| Have I Been Pwned | Free | Email, phone number | Free |

| Aura | Free/Paid | Email, SSN, phone, ID scans | Free trial / $12+ |

| Google One Dark Web Report | Paid (Google One) | Email, phone, address, passwords | $1.99+/month |

| Firefox Monitor | Free | Email breaches | Free |

| IDStrong | Free/Paid | Full identity scan | Free scan / Paid report |

Step 2: What to Do If Your Info Is Found

If any of these tools show your data has been leaked, act fast. Here’s your checklist:

Immediate Actions

- Change All Compromised Passwords Use strong, unique passwords (13+ characters, mix of symbols). A password manager helps.

- Enable Two-Factor Authentication (2FA) Prefer authenticator apps (like Google Authenticator) over SMS codes to avoid SIM swap scams.

- Freeze Your Credit (U.S. only) Contact Experian, Equifax, and TransUnion to prevent new accounts being opened in your name.

- Notify Your Bank’s Fraud Department They can flag your account and help recover stolen funds if needed.

- Check Your Credit Reports Use AnnualCreditReport.com for free weekly reports.

Step 3: Stay Protected Going Forward

Proactive Tips

- Use a Password Manager Tools like 1Password or Bitwarden generate and store secure credentials.

- Monitor Your Identity Continuously Paid services like Aura or Identity Guard scan the dark web 24/7 and alert you to new breaches.

- Limit What You Share Online Avoid posting personal info (birthdays, addresses) on public profiles.

- Keep Software Updated Patches fix vulnerabilities that hackers exploit to steal data.

Final Thoughts

In 2025, data breaches are no longer rare—they’re routine. But with the right tools and habits, you can stay ahead of the curve. Think of dark web monitoring like antivirus for your identity: it won’t stop every threat, but it gives you a fighting chance.